Content begins here

Main page content

Click to collapse

Welcome to Mind Matters week of 23 May 2022

What’s driving hunger in Gauteng, South Africa’s economic power house

Food serves as one of the critical needs a person requires for daily survival. In South Africa it’s recognised as a fundamental human right under the country’s constitution.

Approximately 11% (6.5 million) of South Africa’s population is hungry and food insecure. Conflict and insecurity, climate change, poverty, and population growth are primary drivers of hunger and food insecurity.

A frightening reality. 4 min read available below in .pdf.

Global and local economy: news and opinion

War in Ukraine: Twelve disruptions changing the world

The war is devastating lives and roiling markets. Here we track the disruptions that seem likely to shape lives and livelihoods, beyond the immediate crisis.

A brilliantly illustrated paper providing well substantiated views. 10 min read also available below in .pdf courtesy of McKinsey.

Global economy entering trend growth not a recession

Many investors were left feeling uneasy as the first quarter of 2022 ended. US inflation remained a hot topic, and the general sentiment around the economy's robustness was uncertain. Many concerns were centred on whether the economic environment was suitable enough to withstand the US Federal Reserve’s plans of rate hikes throughout the rest of 2022. Once again, there is a lot of noise, and to get some sense of direction, we need to look at the unbiased evidence and base our economic views on these instead.

We are admittedly in uncertain times, but what is important is not to be swayed by the noise and to rather be informed by unbiased data and facts. Sure we cannot predict exactly what will happen in the next quarter, but what we can do is adjust our positions according to what is currently happening and bring it all together in an unbiased, systematic framework. Author: Shriya Roy – Quantitative Analyst at Prescient Investment Management

Three minute 30 second read. Article published on 28 April, I wonder if it still stands?

Debt costs rise as SA Reserve Bank hikes interest rate by 50 basis points

The increase, the largest since 2016, takes the repo rate to 4.75% and the prime lending rate to 8.25%.

To put that in perspective, if you had a R2-million home loan at the prime lending rate taken over 20 years with no deposit, your monthly instalment just went up by R623 – while your total interest payable over the term of the loan increased by R150,000.

Last week we spoke about the possible increase but we didn't include this article. It is good to be informed. 3 min 30 sec read

Will Godongwana extend the fuel levy reprieve or brace for inflationary pressures?

This time around, Finance Minister Enoch Godongwana has a tough choice to make. Extend the temporary R1.50 fuel levy reduction (introduced for April and May) to enable a softer (R1.20 to R1.70) increase in June, or claw back the levy reduction and witness the reaction and inflationary pressures of a R2.70 to R3.20 increase in the price of petrol unfold.

3 min read of a tough situation.

Old Mutual: we need to think about the longer-term implications of higher inflation

At the launch of its Long Term Perspectives publication, the firm said that there could be a structural change underway.

While market attention is focused on short-term inflation numbers, the MacroSolutions team within the Old Mutual Investment Group believes that the longer-term inflation picture is perhaps more significant.

A good perspective to hold in mind as everyone gets the jitters with current inflation rises. 3 min read

Food prices will ‘go through the roof’, Tiger Brands warns consumers

Tiger Brands expects inflation for some food categories, including staples such as bread, maize meal and baking flour, to rise by between 15% and 20%. For context, inflation for these food categories, mainly bread and cereals, was measured at 4.8% in April this year.

3 min read

Industry news

Can your life insurer pay up 40-years from now?

South Africa’s largest life insurers passed their 2021 ‘health check’ with flying colours, having met escalating obligations to policyholders and maintaining the required capital and liquidity positions despite the challenges posed by the COVID-19 pandemic and accompanying financial market volatility.

This news courtesy PwC South Africa’s latest analysis of major life insurer financial statements, published as Sustaining Impact: Reflecting on past resilience and future challenges of life insurers in South Africa.

The life insurer results reported in the PwC survey show two sides of a story. One, is an industry recovering from an external shock in the form of pandemic. The other, is an industry struggling to make headway in a tough economic environment.

8 minute read covering short reviews of Discovery Life, Liberty Life, MMH, Old Mutual Life and Sanlam Life.

How do you decide between retirement income options in the retail market? Part 1

A comparison of living and life annuities.

When nearing retirement and having to consider your options of where and how to invest your retirement savings (i.e., savings from a retirement annuity, pension or provident fund, or pension and provident preservation funds), one must take a significant amount of information into account.

Two of the options that can be quite a challenge to fully understand and choose between are living annuities and life annuities.

Before reading the article ask yourself what you know about annuities and write that down. Then read the article and see how you fare! 4 min read

Lightning damage and solar panels — how to keep your insurance cover

Insurance companies in South Africa are likely to honour your claim if your solar power installation is damaged by lightning — even on multiple occasions — provided specific protection measures are in place.

These include using lightning arrestors and surge protectors and installing your solar or equipment through an accredited service provider.

Did you know that short term insurance is the fastest growing insurance segment? 3 min read

Investments

SA's big five managers continue to lose market share

In the past five years, only one of South Africa’s five largest collective investment scheme (CIS) managers has grown its market share.

According to the latest statistics released by the Association for Savings and Investment South Africa (Asisa), only Ninety One has grown its assets ahead of the market average, while Allan Gray, Stanlib, Coronation and Nedgroup Investments have all seen their relative share of the market fall since March 2017.

Find out more about the reality of the growth of CIS over the past few years. 3 min read

What is the yield curve telling us?

The market is telling us that the Federal Reserve is doing a poor job of assuring investors that inflation is under control.

I am sure many of us understand that a yield curve is simply the term structure for a particular debt instrument. In other words, it plots the interest rate associated with different contract lengths on a graph. However, it can become quite confusing when trying to understand all the intricacies of what the yield curve is telling you.

This article goes on to explain in simple terms the four states of a yield curve, what is interesting is the reference to the actuarially based tool that is used to pick stocks. 4 min read

Health in the news: Low Cost Benefit Options (LCBO)

Actuary airing misgivings about schemes council’s handling of LCBOs ‘a publicity stunt’: CMS registrar

Well-known healthcare actuary and medical scheme consultant, Christoff Raath’s intimation at the Board of Healthcare Funders (BHF) Conference in Cape Town Thursday that the Council for Medical Schemes’ (CMS’) withdrawal of the proposed Low Cost Benefit Options (LCBO) in 2015 and the “perpetual consultation” in the now seven-year revision process were “deliberate tactics to prevent progress”, has prompted a terse rebuttal from the council in a press statement released Friday by CMS CEO and registrar, Dr Sipho Kabane.

There has been a lot of coverage this past week on the topic. Read a few articles to gain perspective. This is a 3 min 30 sec read.

Medical schemes regulator to ‘examine’ conduct of critic of its low-cost benefits work

Council for Medical Schemes says it is investigating the actuary who accused it of stalling development of cheap options aimed at low-income households.

The Council for Medical Schemes has since 2015 been overseeing the development of a low-cost benefit option (LCBO) framework that will allow schemes to offer cheap primary healthcare cover, exempting them from provisions in the Medical Schemes Act that require cover for a much broader range of services, known as prescribed minimum benefits.

This is an article in Business Live which you will need a subscription for, but suffice it to say that the CMS has retaliated quickly to accusations of stalling LCBOs. There will be more news on this investigation shortly.

‘Low-cost benefit framework could give a third of South Africans access to basic private health care’

Up to 20 million low-income South Africans could afford basic private healthcare services if the Council for Medical Schemes (CMS) developed a framework for low-cost benefit options (LCBO), according to Business Day.

The CMS was tasked with developing a LCBO framework after the government after demarcation regulations came into effect in April 2017. The framework will allow medical schemes to offer options that are exempt from providing the prescribed minimum benefits.

This article will broaden your understanding of the LCBO and other NHI related issues. 3 min 30 sec read

BHF criticises CMS for not updating PMBs and lack of movement on low-cost benefits

The failure by the Council for Medical Schemes (CMS) to review the prescribed minimum benefits (PMBs) regularly is making private healthcare unaffordable for millions of people, according to the Board of Healthcare Funders (BHF).

The BHF was responding to the media statement issued by the CMS earlier this week. In it, the regulator’s chief executive and registrar, Dr Sipho Kabane, took exception to comments by Insight Actuaries & Consultants joint-chief executive Christoff Raath at the BHF’s recent annual conference.

More insight into the ongoing argument on the CMS stalling the process of introducing LCBOs. 3 min read

Climate Change and ESG Investing

The net-zero transition in the wake of the war in Ukraine: A detour, a derailment, or a different path?

The invasion of Ukraine will, at least initially, complicate the transition path to a net-zero economy, but this tragic development could still prove to be a turning point in accelerating progress in the medium run.

The war in Ukraine has not only unleashed a humanitarian tragedy but has also dealt the effort to achieve net-zero greenhouse-gas emissions a powerful supply-side shock. Yet for public- and private-sector leaders willing to take the necessary bold steps, the new logic of energy security and economics holds the promise of making this a turning point in seizing the opportunity to address the globe’s unfolding climate crisis.

Another well written and researched article from McKinsey. 10 min read and available below in .pdf not to be copied.

Climate change

Is climate change the greatest threat facing humanity today?

Could climate change lead to the end of civilisation?

Across the world, over half of young people worry that, as a result of climate change, humanity is doomed.1 They feel angry, powerless, and — above all — afraid about what the future may hold.2

Climate change matters so much, to so many, not just because of the suffering and injustice it’s already causing, but also because it’s one of the few issues that has obvious potential to affect our world over many future generations. We think safeguarding future generations is a key moral priority, and should be a crucial consideration in prioritising problems on which to work.

A thought provoking article from 80,000 hours - a website that you should become familiar with. Read sections of the article as it is very long (20 min read), however a short summary is provided (one minute read) and a margin with the main sections displayed.

A long-term plan to integrate ESG factors in strategic decision-making is critical

When we finally put the effects of war and the pandemic behind us, the challenges of the climate crisis, environmental degradation, waste, poverty and water scarcity – to name but a few crises – will still be with us. Environmental, social and governance issues affect long-term sustainability, no matter the demands of the moment.

Global shocks – Covid-19 and the war in Ukraine – have dominated headlines and absorbed public attention over the past few years, to the extent that longer-term threats have been eclipsed.

In 2021, Pick n Pay was the top retailer in South Africa on the IRAS Sustainability/ESG Data Transparency Index. 5 min read

Carbon-neutral commitments lacking in SA corporates

South African firms are significantly lagging behind global counterparts in terms of carbon-neutral and net-zero commitments and implementation.

This is according to PwC’s environmental, social and governance (ESG) South Africa report released this week. The study, based on a survey of South African CEOs, summarises critical issues affecting society, companies and individuals that are challenging to resolve.

3 min read

Canada Releases Draft Guidelines to Manage Financial Risks of Climate Change

A Canadian financial regulator released draft guidelines on Thursday to mitigate the risks of climate change as the country’s financial institutions prepare for mandatory disclosures starting in 2024.

The guidelines, issued by the Office of the Superintendent of Financial Institutions (OSFI), call for annual climate-related disclosures on governance, strategy, risk management, metrics and targets, and greenhouse gas emissions, as well as a transition plan, for periods starting October 2023.

SA is far behind at this stage. 2 min 30 sec read

Dutch Insurer NN Group Expects to Accelerate Exit From Coal Investments

World leaders gathered in Davos this week worried that market gyrations would disrupt the transition to green energy and that companies would fail to meet their goals to reach net zero in the coming decades. Some countries have already turned to coal to meet their energy needs.

2 min read

About you

Self management and exam preparation

A short prezi presentation of six minutes giving you some hints on how to prepare for exams and handle the anxiety that comes with it.

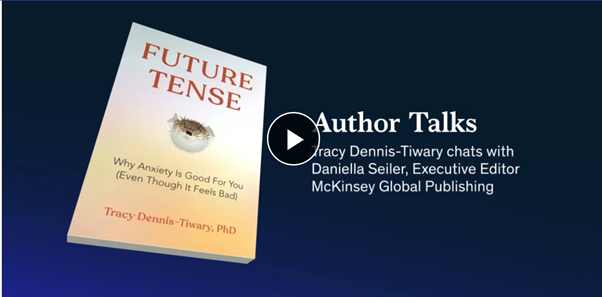

Author Talks: Make anxiety your ally

How can we reclaim our relationship with anxiety, so it works for, and not against, us?

Though anxiety has become a largely universal experience during the COVID-19 pandemic, Dr. Dennis-Tiwary says it’s still misunderstood—and in need of a mindset shift. Rather than a bug or malfunction, she argues that anxiety is a useful and even transformative human feature that can help us create, innovate, and find meaning. An edited version of the conversation is available on the site above.

"In the book, I talk about a three-part framework for this. One is that we remember that anxiety is information, and we need to listen to it. Two is that sometimes it’s not useful information. We can learn to tell the difference. And when we know it’s not useful anxiety, we use the tools we have to let go and immerse ourselves in the present moment, get help through therapy, do those things that help us scale back from the future. Three is to hitch that anxiety to purpose, to something that really matters to you."

The site has several short videos of about 3 mins each exploring major elements of anxiety and how we can turn it into something positive. Or watch the full 15 min interview in one video.