Content begins here

Main page content

Click to collapse

Welcome to MM's first edition of August 2023!

Diversity and Inclusion

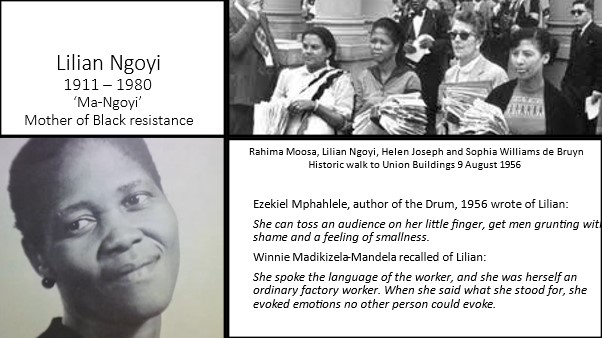

Lilian Ngoyi: an heroic South African woman whose story hasn’t been fully told

On 9 August 1956, now commemorated as Women’s Day in South Africa, Ngoyi and other woman leaders led an estimated 20,000 women to the Union Buildings in Pretoria, the seat of power of the white minority government. They were protesting extending the much-hated pass laws to women. These laws required black citizens to carry pass documents to better control their movement.

5min read

10 tips for women and their finances this women’s month

As a woman, working in the financial industry, I can attest to how it has enriched my life. Yes, I have been faced with challenges as a woman in the industry, but it has also been a greatly rewarding journey to be not only financially empowered but also to be a woman in a leadership role within the industry. Victoria Reuvers, Managing Director of Morningstar Investment Management SA

4min read

Economic matters

South Africa and China agree to R41.2 billion trade deals

The agreements were made at a meeting of a joint economic and trade committee aimed at boosting South African manufacturing exports to China and Chinese investment in the Southern African country, South Africa’s Trade, Industry and Competition Minister Ebrahim Patel told journalists on Thursday.

1.5min read

SARS’ Edward Kieswetter kisses R77 billion goodbye

Load-shedding could reduce South Africa’s tax collection by R77 billion this year as it is expected to cost the economy R400 billion more than last year, according to Electricity Minister Kgosientsho Ramokgopa.

2min read

South Africa needs to borrow R2 billion a day

South Africa will need to borrow R500 billion over the next year, or R2 billion per weekday on average, to fund its current fiscal deficit and refinance maturing debt. This increases the risk of investing in the country and increases borrowing costs for local companies.

2min read

Financial Services Industry

Insurance, a Mutually Beneficial Service

South Africa is a challenging environment with low growth impacting the financial services industry and our consumers. We are confronted with many challenges that people in other places do not have, like load shedding and talks of grid failure. All these things are not even on the radar of our counterparts in other countries.

A must read interview in the July edition of COVER (from page 11) giving understanding of the concept of mutuality and what insurers have to contend with in SA that forces them to innovate. 8min read

Why the extradition of Manuel Chang from SA is a big deal

" … [a] shameful fact that the amount of illicit funds that have been siphoned out of Africa more than equals what the continent has received in development aid and loans. In 2015, African countries received $162 billion, mainly in loans, aid and personal remittances. In the same year, $203 billion was funnelled out through multinationals repatriating profits and illegally moving money into tax havens. “

Read this article carefully as the writer is sarcastic at times, usually pointing a finger at government who are complicit in robbing citizens of their country’s wealth. Note the comments below the article as well. 4min read

Who is the ultimate beneficiary?

The design of anti-money laundering (AML) and combating the financing of terrorism (CFT) controls aims to frustrate bad actors such as rogue states, criminals and terrorists in their attempt to gain access to finance.

Read the article above which spells out how important it is to pinpoint the beneficiary in the drive to identify money laundering. 3min read

What customers look for when choosing financial products and services

South Africans aspire to own investment products, but these products are not well understood, according to research by the FSCA.

Is the customer being left behind? Good overview if the report. 5min read

Life Insurance

Analysing Trends in Life Risk Claims: Insights from Petrie Marx

In this interview, Petrie Marx, Product Actuary at Sanlam Risk and Savings, discusses the recent increase in life risk claims from young individuals and delves into the past year's claims experience.

15min listen

All things endowment

Endowments are frequently seen as inflexible. There is also some scrutiny around what returns look like based on market conditions upon maturity. As a specialised solution, endowments can be the perfect key for the right lock. It’s just a question of pairing the product with the correct client.

This isn’t life insurance, but it is a product that you should know about. It fits in with the theme for this week on identifying the beneficiary and is on page 30 of the July COVER magazine. 3min read

General Insurance

Severe Convective Storms Top Insured Natural Disaster Losses in H1: Swiss Re

“The above average losses reaffirm a 5%-7% annual growth trend in insured losses, driven by a warming climate but even more so, by rapidly growing economic values in urbanized settings, globally. The cyclone and flood events in New Zealand in the first quarter of 2023 are testimonies of the risk to today’s large urban centres, continuing patterns observed in 2021 in the Germany flooding, and in 2022 in Australia and South Africa.” Martin Bertogg, head of Catastrophe Perils at Swiss Re.

2.5min read

Insuring the Future: How Gen Z Digital Natives Are Transforming Insurance

Generation Z insurance consumers – or those born between roughly 1997 and 2012 – want the insurance process to be authentic, honest, and immediate. That’s according to guests on The Insuring Cyber Podcast’s quarterly InsurTech update episode.

Would you agree with this if you’re a Generation Z consumer? This podcast is 36min. The abbreviated text version is 3min.

Navigating the Challenges of Wildfire Risk Modelling

As wildfires raged across Northeastern Canada in June, spreading toxic smoke across a large swath of Eastern and Central U.S., risk and insurance executives were reminded of the myriad challenges associated with wildfire risk.

Read more about the complexity of wildfire risk and how modelling can help. 4min read

Taming the flame, from local to global extreme wildfires

The societal and environmental impacts have spurred Australia to rethink wildfire management and work toward innovative solutions.

Enlightening article. 8min read

Health Insurance

CMS releases guidelines on medical scheme increases for 2024

The circular describes the outlook for the key macroeconomic indicators that will affect the medical schemes industry in 2024: global economic growth, the South African economy, interest rates, exchange rates, and employment. These factors directly and indirectly affect the affordability of contribution rates, the financial performance of schemes, the membership growth, and the industry’s long-term sustainability.

Broad coverage of the guidelines provided. 5min read

Dose of reality splatters NHI fantasy

In fact, finally, some glimmer of realism appears to be peeking through, writes Financial Mail editor Rob Rose after speaking to Deputy President Paul Mashatile.

This above article is a backdrop to the one below. 3min read

Other options than NHI for quality UHC

One of the most damaging aspects of our public discourse on National Health Insurance (NHI) is the mistaken notion that the only two options are NHI and the status quo, observes Spotlight editor Marcus Low.

Well written article which is well worth reading. 5min read

Banking

Standard Bank to finance R300 billion in renewable projects by 2026

CEO of Standard Bank’s corporate and investment banking division Kenny Fihla told CNBC Africa that the bank is seeing increased demand for funding from renewable projects across the continent.

2min read

Nedbank to power up private electricity generation

This was revealed by Nedbank COO Mfundo Nkuhlu this week in an interview with ITWeb, after the company announced its interim financial results for the six months to 30 June.

3min read

Investments

Meet wealth manager Nicola Langridge

What is keeping you awake at night? I’m concerned about the current socio-political issues affecting the South African economy and the fear it creates in local investors.

This situation is frustrating and one of the reasons that everyone needs a sound, informed, trusted wealth manager to help mitigate dangerous knee-jerk [financial] decisions. However, I have hope and faith in our beautiful country and incredible people.

3min read

Peregrine Capital 25th Birthday – How SA’s oldest hedge fund pioneer generates those 100x returns

This interview explores the 25-year success story of Peregrine Capital with its co-founder and executive chairman, David Fraser, and CEO, Jacques Conradie. They share insights into their investment philosophy and strategies, emphasising the importance of backing strong franchises and conducting thorough fundamental research.

Listen to or watch the interview (28min) or read an abbreviated version. 10min.

Veteran PM: ‘Thinking and being more unconventional pays huge dividends’

Gavin Wood has been chief investment officer of Camissa Asset Management and its forerunner Kagiso for more than 20 years. During that time, he has reckoned with how best to achieve maximum value from an investment team.

Refreshing and noteworthy tips. 3min read

Disentangling risk in S.A. government bonds

S.A. government bonds endured a tough second quarter, delivering a negative return of 1.5%. Longer maturity issues were especially weak and sold off heavily alongside the rand, as adverse investor sentiment contributed to increased volatility in the domestic bond market..

This article is very thorough in its explanation of the risks. 10min read

Retirement / Pensions

Constitutional court overturns ‘deeply disturbing’ retirement fund rule judgment

The Constitutional Court has ruled that an amended retirement fund rule cannot be applied to the calculation of a benefit that accrued before the amendment was approved and registered.

An interesting case that you may have heard of previously. If not, the article provides good context. Do you agree with the outcome? 7min read

About YOU

Why you should go to sleep at the same time all week

Small differences in sleeping habits between work and rest days could lead to unhealthy changes to the bacteria in our guts, a study suggests.

This may be partly a result of people with "social jetlag" having slightly poorer diets, the UK researchers found.

Find out more! 3min read

Why do I fall asleep on the sofa but am wide awake when I get to bed?

Sleep pressure is one reason why you fall asleep on the sofa. This refers to the strength of the biological drive for sleep. The longer you’ve been awake, the greater the sleep pressure.

Your body clock or circadian rhythm is another factor. This tells you to be awake during the day and to sleep at night.

A good companion article to the one above. 5min read

Clear Thinking: Turning Ordinary Moments into Extraordinary Results

This is the title of Shane Parrish’s book which is about to be released. Please check out the page as it provides an overview of the book with excellent reviews. Adam Grant has this to say:

“An actionable guide to using your mind more effectively. Shane Parrish doesn’t just teach clear thinking—he lives it. He’s produced a lucid manual for overcoming cognitive biases and making better decisions.”

– Adam Grant, #1 New York Times bestselling author of THINK AGAIN