Content begins here

Main page content

Click to collapse

Welcome to Mind Matters week of 7 March 2022

This week on 8 March is the International Day for Women and I couldn’t pass up the opportunity to bring you articles that would highlight our significance in the world, homing in on insurance, IT and activism to promote change. To all our young women readers, own your space in the world at least 50% of it is rightfully yours!

Russia - Ukraine War: Impact, implications and interwoven relations across the globe

UKRAINE – THE SECOND IRON CURTAIN - 4 MARCH 2022

This political research note was prepared by JP Landman in his personal capacity. Landman is an independent political and economic analyst, and the opinions expressed in this article are his own and do not reflect the views of Nedbank Group.

Landman provides excellent historical and current perspective which sheds light on why SA abstained from voting at the special UN meeting. The article is below in .pdf courtesy of Nedbank Private Wealth.

Ukraine Invasion Analysis: AM Best Sees ‘Significant Implications’ for Insurers

AM Best believes that Russia’s invasion of Ukraine could have a “substantial impact” on the world’s insurance industry in the near to midterm, the rating agency said in a report published on Friday.

The report, “Significant Implications of Ukraine Invasion on Global Insurance Industry,” cited the fallout in the capital markets and potential for widespread cyber attacks, among other drivers.

This is to highlight that the insurance industry is not exempt from being affected by this war. 2 min read.

Could the Ukraine invasion spark a global financial crisis?

With over US$100 billion of Russian debt in foreign banks, this raises questions about the risks to banks outside Russia – and the potential for a default to kick off a 2008-style liquidity crisis, where banks panic about the state of other banks’ solvency and stop lending to one another.

A very interesting article, a must read given the context of the war. A 4 min 3- sec read and a .pdf of the article below.

China-Backed Development Banks Halt Russia Loans Amid Sanctions

The China-backed Asian Infrastructure Investment Bank halted all businesses with Russia and Belarus amid rising geopolitical tensions, a sign of Beijing’s cautious approach to financial support to Russia amid sanctions.

The multilateral lender said in a statement Thursday that “all activities relating to Russia and Belarus are on hold and under review,” as it strives to do their utmost to safeguard the financial integrity of the bank. While expressing sympathy and offering support to those who have been adversely impacted by the war, the statement didn’t condemn the war or announce any further measures against the two countries. China was seen as a potential bulwark for Russia, with the nation’s commerce minister saying recently it hopes to keep normal trade with both Russia and Ukraine. China’s banking regulator said Beijing doesn’t support unilateral financial sanctions on Russia and won’t join Western nations in imposing the restrictions.

Xi’s Europe Outreach Aims to Avert East-West Clash For China

A flurry of diplomatic calls between Beijing and European capitals shows how President Xi Jinping is trying to keep Russia’s invasion of Ukraine from dragging China into the center of another struggle for global supremacy reminiscent of the Cold War.

Xi spoke via video link Tuesday with French President Emmanuel Macron and German Chancellor Olaf Scholz, suggesting China would be willing to work with the two countries to mediate a solution. The summit follows Foreign Minister Wang Yi’s calls with top regional diplomats including Josep Borrell of the European Union and Peter Szijjarto of Hungary.

An interesting article showing how balance of power is so critical to world peace and economic prosperity. 4 min read

Ukraine war: fresh warning that Africa needs to be vigilant against Russia’s destabilising influence

It’s commonly held that Russian president Vladimir Putin’s objective for invading Ukraine is to install a puppet regime that is pliable to Moscow’s interests. If so, this would be consistent with the approach Russia has taken with its forays into Africa in recent years.

Drawing from its Syria playbook, Russia has propped up proxies in Libya, Central African Republic, Mali and Sudan. Moscow also has its sights on another half dozen African leaders facing varying degrees of vulnerability.

In the process, African citizen and sovereign interests have given way to Russian priorities.

This article shines light on relations with Russia and how persuasive they are for Africa. 4 min read and article is available below in .pdf.

Russia-Ukraine war: decoding how African countries voted at the UN

In recent weeks the world has witnessed the most tense moments in international relations since the end of the Cold War. This was evident in the deliberations and voting by members of the United Nations on resolutions calling on Russia to halt its invasion and withdraw its forces from Ukraine.

The events have also been a stress test for military and political alliances.

This article builds understanding of the complexity of power at presidential level. 4 min read available in .pdf below.

Ukraine: what will end the war? Here’s what research says

In a matter of days, Russia’s invasion of Ukraine has escalated to one of the biggest military conflicts in Europe since the second world war. The fog of war can obscure our view of who is winning, who is losing, and how long all of this will last. While no one can provide definitive answers, academic research on war gives us some insights into how the conflict in Ukraine might unfold.

Such an interesting article - well worth reading to understand the principles of war. 4 min read and a .pdf below

How I got home ... student recounts fleeing from Kharkiv

South African Mandisa Sthabile Malindisa (25) travelled for four days, slept on icy roads and muscled her way through desperate crowds on several station platforms and onto trains before she reached Budapest airport in Hungary to board a plane to Johannesburg. She is feeling guilty that she escaped while others are still trapped in Ukraine.

More articles from University World News shows that it is not easy for any students of colour to leave Ukraine. 3 min 30 sec read

Bizarre but true – Ukraine War is boosting the Rand. Here’s why – Andre Cilliers

South Africa is the only functional democracy that did not join the United Nations’ condemnation of Russia’s invasion of Ukraine. Bizarrely, its currency is also one of the few beneficiaries of the war. Despite a flight to quality elsewhere, the rand has strengthened against the euro and sterling since the first shots were fired almost two weeks ago. In this podcast, forex specialist TreasuryONE’s Andre Cilliers – currency risk strategist – explains why this is not as irrational as it first appears.

This is so very interesting because it is an economic view pitted against a philosophical one. 4 min read

Ukraine: how the world’s defence giants are quietly making billions from the war

The Russian invasion of Ukraine has been widely condemned for its unjustified aggression. There are legitimate fears of a revived Russian empire and even a new world war. Less discussed is the almost half trillion dollar (£381 billion) defence industry supplying the weapons to both sides, and the substantial profits it will make as a result.

Please do read this and ask yourself the question where you would invest at a time like this! 4 min read also available below in .pdf

International Women's Day: Promoting the ascent of women in the workplace

Women in insurance: Leading voices on trends affecting insurers

As part of our celebration of International Women’s Day 2022, female McKinsey partners offer insights into the latest in insurance: new technologies, new services, and new customers. Their expertise covers all relevant topics, functions, and lines of business.

22 Women in Insurance across the globe give their insights into their specialist areas. Pick a topic that interests you and read the interview. each article is a 2 min 30 sec read.

Network launched to support women in the local finance industry

The launch of the Women in SA Financial Services Network coincides with International Women's Day.

The launch takes place on International Women’s Day, which Carolyn Erasmus, country head at Bravura Solutions said was ‘the perfect opportunity to remind the industry of the importance of gender equality and the role that diversity plays in achieving overall business success’.

According to Citywire’s latest Alpha Female report, female representation at fund manager level in the country has stagnated. It was 10.6% in 2019, and 10.7% last year.

This is emblematic of how many areas of financial services remain largely male-dominated.

A short read but there is a link to the network which will give you more insight.

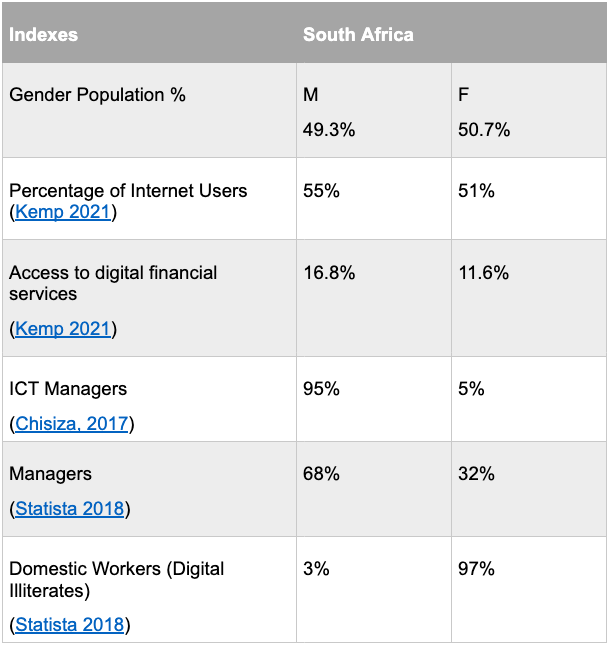

Women are being squeezed out of the digital economy

As government pins its hopes for our economy on the transformative power of the Fourth Industrial Revolution, it must also take account of the need for specific and targeted policies to bring women and girls into the digital space, and ensure that gender gaps are closed across the board.

4IR has revealed considerable inequality in South Africa, especially among unskilled and low-income citizens, among whom women and girls represent the majority. Factors such as gender stereotyping, digital illiteracy, inaccessibility to data and discrimination have confirmed digital gender exclusion in the country.

An insightful read - inclusion is a principle that should be pervasive - maybe you can make sure it is in your interactions with others. 4 min read

Gender parity success for SA’s astronomy entities

The South African Astronomical Observatory (SAAO) and the South African Radio Astronomy Observatory(SARAO) are heeding the call when it comes to increasing women participation within their organisations.

Both entities of the National Research Foundation (NRF), SAAO and SARAO are key agencies involved in the country’s astronomy-related activities, including the Square Kilometre Array (SKA) radio telescope.

Find out more about the opportunities for women in these pioneering areas of science. 4 min read

Google commits R15.3m to support women-led businesses

The announcement comes as the world marks this year’s International Women’s Day.

Commemorated annually on 8 March, International Women's Day is a global day celebrating the social, economic, cultural and political achievements of women. This year’s call to action is to “imagine a gender-equal world: a world free of bias, stereotypes and discrimination”.

Great news. 3 min 30 sec read.

Local Industry and Financial News

New business and expense management drive Momentum Metropolitan’s spectacular recovery

Normalised headline earnings jumped 51% to R1.5-billion on the back of the value of new business, growing 20% from the prior period to R400-million. The recovery was driven by strong new business volumes and good expense management. The group also saw a 23% increase in the value of new business premiums to R37-billion.

Across all businesses, the claims experience from the Omicron wave was significantly less severe than the third wave.

Meyer says that for the second quarter of the 2022 financial year, the South African life insurance businesses paid R2.4-billion in gross mortality claims. Momentum Metropolitan saw net mortality losses of R51-million for that quarter alone.

Comparison across the life insurance business in SA is useful to provide context. A 3 min read

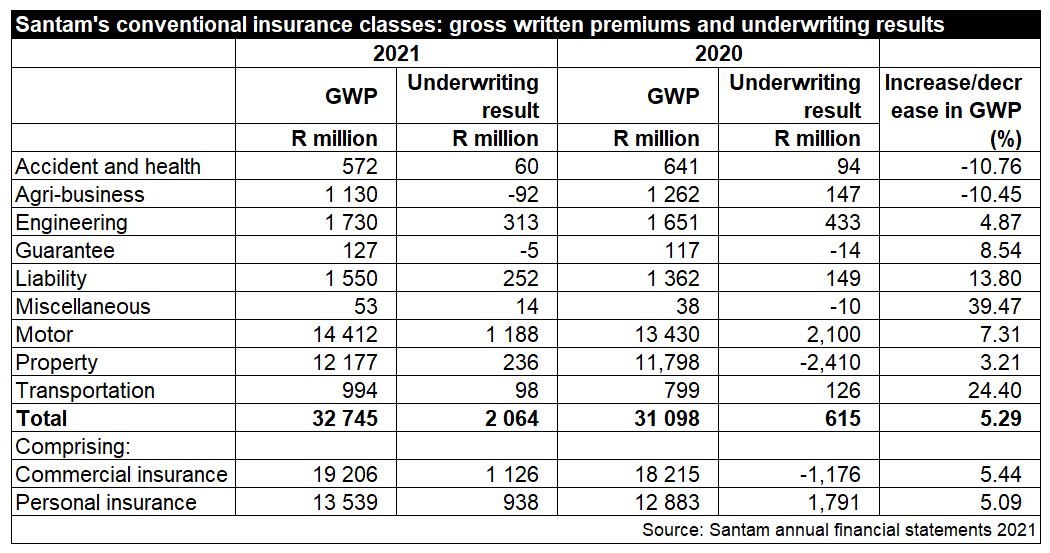

R3.2bn of Santam’s record R24.5bn claims pay-out went to BI policyholders

Santam paid out R24.5 billion (2020: R21bn) in claims last year, the highest gross claims pay-out in its 104-year history, the country’s biggest short-term insurer said in its financial results for the year to the end of December 2021.

Despite the big claims pay-out, Santam’s earnings rose to R2.75bn, compared to R327 million in 2020, and shareholders have reason to smile again after receiving no dividends in the previous financial year.

See below the premiums for the past year. A 3 min read

PA loses bid to remove Ram as 3Sixty Life’s curator

The Prudential Authority (PA) has lost its urgent application to replace Yashoda Ram as the provisional curator of 3Sixty Life, with the Gauteng High Court ruling on Thursday that the regulator had “adopted an incompetent procedure” to seek her removal.

A very interesting case if you haven't been following it. If you don't know anything about curatorship and the role an actuary plays in this process, this would be a good topic to follow. No FSP likes to be "under curatorship" as it has negative connotations for business. We'll follow the outcome of the court case on 22 March. 3 min read (note related articles provided)

SA cannot avoid tax increases, says Finance and Fiscal Commission deputy chairman

“We need to have a serious debate about raising taxes, because taxes are going to have to go up. There is no doubt about it in my mind,” Michael Sachs, the deputy chairman of the Finance and Fiscal Commission (FFC), told Parliament last week.

Sachs said personal income tax, corporate income tax and VAT will have to increase.

This is a reality check on the budget speech from two weeks back. Note the three areas that need to be addressed to reduce the debt service SA has which is the bulk of the expenditure in the budget. Do you agree with this perspective? 3 min read

Investments: How are they doing?

Truffle: You can’t ignore that the war has increased a range of market risks

Iain Power thinks that risks to economic growth, energy prices and consumer spending have all ‘ratcheted up.

Truffle Asset Management chief investment officer Iain Power says investors must appreciate that Russia’s invasion of Ukraine is a significant market event. It has fundamentally shifted geopolitical risk and risks to the economic recovery.

This article comes from an asset allocation perspective. A 3 min 30 sec read

Investing in 2022: Look local

After the unusually high returns from SA equities (and even local bonds) that investors enjoyed in 2021, some may be expecting lower results in the next few years. After all, some headwinds to growth are presenting themselves in the form of rising inflation, higher global and local interest rates, the potential of new Covid strains, geopolitical tensions, and political concerns both locally and abroad, all arising from the interconnected world we live in. Also, importantly, starting valuations for both SA equities and bonds are now more expensive than they were at the beginning of last year.

Article from M and G investing. Always read a range of investment articles to help build your knowledge in this area. 3 min 30 sec read

South African Assets Become Unexpected Haven for Foreign Buyers

The rand has shown resilience this month despite its tag as a proxy currency for emerging-market sentiment, while money from non-residents has been pouring into South Africa’s bonds and stocks in recent days.

A 2 minute read from Bloomberg showing some interesting stats for the past month. How long will it last? 2 min 30 sec read

The Financial Wellness Coach: Offshore portfolio jitters and a home loan dilemma

Question: Last month I invested R36,000 in a tax-free investment using an aggressive offshore portfolio to take full advantage of the lack of capital gains tax. I was horrified to see that my investment is now worth only R25,000 following the outbreak of the war between Russia and Ukraine. Do I disinvest and put my money in a more conservative portfolio?

This is a lovely exercise - first consider then go to the article! A 4 min read.

ESG and all things renewable

ESG and Article 8 funds face questions over Gazprom holdings

Following the invasion of Ukraine, sustainable investors might need to reassess their commitments, especially when it comes to state-owned enterprises.

State-owned enterprises were often a thorn in the side of sustainable investors, but the Russian invasion of Ukraine brings names such as Gazprom into sharp focus.

The company is both a champion of the Russian state and a dominant force in the European energy market.

Is investing only about money or should you be concerned about the way the companies are run and by whom? A 4 min read

Here's how ESG investors can really help Ukraine

By indiscriminately divesting from Russian assets ESG investors might make a point, but will also miss the bigger picture.

Don’t get me wrong, many Russian assets have questionable ESG credentials, be it environmental or human rights, and should be scrutinised accordingly.

However, divesting from all Russian equities and all bonds may not be as effective as investors think.

A very good article to complement the one above and address the question of values as opposed to value. 3 min 30 sec read

R600m windfall for SA’s renewable energy sector

The South African renewable energy industry today received a R600 million boost from Norfund, the Norwegian investment fund for developing countries, and CDC Group, the UK's development finance institution (DFI).

The organisations have invested in H1 Capital (Norfund R360 million and CDC R240 million) – a South-African black-owned and -managed renewables investment and development company.

Positive news for SA and the renewable energy sector. A 3 min read

Animals have evolved to avoid overexploiting their resources – can humans do the same?

People have been trying to understand how predators and prey are able to stay balanced within our planet’s ecosystems for at least 2,400 years. The Greek author Herodotus even raised the question in his historical treatise “Histories”, written around 430 BC.

And when Charles Darwin published in 1859 his revolutionary theory of evolution in “On the Origin of Species”, this raised an even more difficult question: why do predators not evolve to become so aggressive that they eat all their prey and then go extinct themselves?

An incredible short essay on "prudent predation" and where we as humans may have gone wrong. a 4 min 30 sec read available below in .pdf

Fintech, Crypto and AI

MTN eyes Q2 to spin off lucrative fintech business

MTN Group has set the second quarter of 2022 financial year as the deadline to spin off its lucrative fintech business, while the fibre unit will be unbundled a few months later.

Ralph Mupita, MTN Group CEO, who is leading the telco’s audacious plan to create a fintech operating company, revealed the details today, saying the work to separate the two is progressing.

A 4 min 30 sec read

TymeBank rolls out medical insurance product, hits 4.5m customers

Digital-only bank, TymeBank has partnered with National HealthCare Group to introduce TymeHealth, billed as one of the most affordable medical insurance solutions available to local consumers.

The in-app service provides medical insurance from R139 a month.

As a medical aid product, the TymeHealth offering comprises three different plans; each designed to cater for different life stages or needs of the consumer, says the digital bank.

A 2,5 minute read. I wonder what next TymeBank will offer? Short term insurance? Life insurance?

Metaverse presents next-gen cyber threats, warn experts

South African companies such as MTN, which have entered the “metaverse universe”, should be cognisant of a number of novel cyber security risks that may have dire ramifications in the real world.

Presenting a keynote address the ITWeb’s Business Intelligence Summit 2022 this week, Anna Collard, SVP of content strategy and evangelist of security firm KnowBe4 Africa, highlighted the vast data and security challenges posed to businesses exploring the metaverse, non-fungible tokens (NFT), crypto as well as the blockchain ecosystem.

Read more about the relatively unregulated Web 3.0 and the limits of being able to police what happens in the virtual world and therefore insure. I thought blockchain was meant to be the most secure form of transacting. Nothing is untouchable it seems. A 4 min 40 sec read.

Nedbank’s R9bn tech bet pays off

Big-four bank Nedbank’s R9 billion investment in refreshing its technology stack is beginning to bear fruit.

That’s according to Nedbank chief operations officer, Mfundo Nkuhlu, in an interview with ITWeb this morning after the JSE-listed group delivered a strong financial performance for the year ended 31 December 2021, as headline earnings increased by 115% to R11.7 billion, although remaining 7% below 2019 levels.

Nedbank’s strategy is delivered through five strategic value unlocks that include delivering innovative client solutions; engaging in ongoing disruptive market activities; focusing on areas that create value; driving efficient execution; and creating positive impacts.

An informative article which talks to the five pronged value strategy mentioned above. You can map these directly in the content. A 5 min 30 sec read.

Bitcoin Price Surges on Biden’s Crypto Executive Order

Cryptocurrency advocates celebrate order while skeptics see it as a step back for regulation

WASHINGTON—Bitcoin’s price surged on President Biden’s executive order to study digital currencies, a move the industry welcomed and skeptics decried as delaying needed regulation.

An interesting development in the US which may see other countries following suit. It is an ongoing debate whether and how one should regulate the trade in cryptocurrency A 5 min read.

Mazi set to launch its first AI-driven hedge fund in 2022

The fund manager plans to use sophisticated AI models to select stocks using valuation, momentum, and growth variables for its new hedge fund.

This year, Mazi Asset Management will launch its third hedge fund and its first driven by artificial intelligence (AI).

The fund manager already has two hedge funds: its market-neutral hedge fund, which it launched in 2006, and a long/short hedge fund, which Mazi has run since 2013.

Recently the firm hired two new portfolio managers, Stephán Engelbrecht and Alungile Gcaza, to develop the AI capability for running the fund.

A 3 min read, it will be interesting to see how the fund progresses for the quantitative analysts in the readership.

About you

This week's reflection comes directly from James Clear

Poet May Sarton on the importance of rest:

"I always forget how important the empty days are, how important it may be sometimes not to expect to produce anything, even a few lines in a journal. A day when one has not pushed oneself to the limit seems a damaged, damaging day, a sinful day. Not so! The most valuable thing one can do for the psyche, occasionally, is to let it rest, wander, live in the changing light of a room."

Source: Journal of a Solitude

I.

"What starts as an excuse can easily become a habit.

Don't let a bad day become a lifestyle."

II.

"Life is a series of seasons, and what works in one season may not work in the next.

What season are you in right now? What habits does that season require?"

III.

"Awareness is often enough to motivate change.

Simply tracking your food intake will motivate you to alter it. Merely writing down your problems may spark ideas for possible solutions.

The process starts with seeing reality clearly."

View James Clear's work here