Content begins here

Main page content

Click to collapse

Welcome to Mind Matters 6 April 2021

Thought for the week:

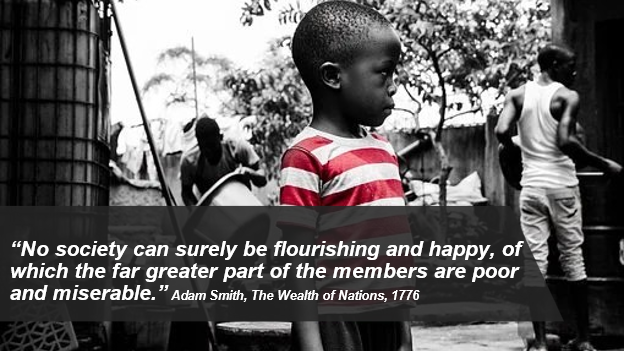

"Emerging from the toughest economic year in the country since the Great Depression with a devastating 7% contraction in GDP in 2020, times are tough for South Africans." Universal Healthcare

All Things Actuarial

ACTUARIAL SCIENCE. THE FUTURE. REIMAGINED

There are aspects of UJ’s BSc Actuarial Science degree that are unique in the marketplace. For example, UJ actuarial science students do a full year of Computer Science in their first year. UJ also encourages its students to go above and beyond the standard actuarial syllabus through exposure to talks and lectures on a range of topics and customised leadership training for students. An example is the Time to Think leadership workshop offered to UJ’s BSc Actuarial Science students. The programme is designed to improve students’ quality of thinking and leadership skills by actively learning about how to improve the quality of relationships that they build as leaders in our modern world.

Over 70 pages of interesting articles for you to browse through, but take a good look at pages 61- 70. These will be experiences that you can relate to directly.

International News

"The system has held up under the latest strain, but this isn’t a victory. Archegos means one who leads the way. Regulators must do what they can to ensure as few as possible follow."

Rochelle Toplensky and Telis Demos, WSJ

Archegos’s Collapse Is a Wakeup Call for Regulators

Post-crisis capital requirements have saved Credit Suisse and Nomura from more serious problems while also pushing risk into darker corners of the financial system

Archegos’s family office structure, whereby it undertook to invest its own money rather than acting for clients, allowed it to keep its hedge fund-like activities relatively private.

On first reading the story appears to offer a fairly clear endorsement of tighter banking regulation since the 2008 banking crisis, which has probably saved Credit Suisse and Nomura from deeper harm. But there is a wrinkle: Some of the roots of the Archegos blowup also can be traced back to postcrisis regulation.

This is an illuminating article unpacking how it was possible that Archegos collapsed, more interesting for those with a quantitative finance interest. This three minute article is from the Wall Street Journal and you may need to tap in on your institution's subscription to read it.

What Is a Total Return Swap and How Did Archegos Capital Use It?

The common Wall Street derivative has for years faced scrutiny from regulators and some well-known investors

Archegos Capital Management’s investments were partly concentrated in a common Wall Street derivative, called a total return swap, that has for years faced scrutiny from regulators and even some well-known investors.

What is a total return swap?

Total return swaps are contracts brokered by Wall Street banks that allow a user to take on the profits and losses of a portfolio of stocks or other assets in exchange for a fee. Swaps allow investors to take huge positions while posting limited funds up front, in essence borrowing from the bank.

You can see how this would be a high risk operation particularly if your business was completely founded on total swaps. Fascinating reading again from the Wall Street Journal.

Top three take-away lessons from the Suez Canal blockage

What maritime lessons can be learnt from this incident?

Choke points: The shipping industry provides an extremely efficient link to ensure just-in-time deliveries. This link, however, is largely invisible, underlined by the time it took most countries to classify seafarers as key workers during the COVID-19 pandemic.

When choke points are blocked, trade doesn’t necessarily come to a standstill. Under normal circumstances, it is extremely cheap to transport all types of cargo over long distances on ships. Freight rates are barely noticeable in the price of most goods, so higher freight rates are unlikely to be a significant issue for economies as a whole. Nevertheless, the implications of a blockage as we’ve seen in the Suez Canal will have been felt in many sectors. For example, refineries need crude oil, factories need raw materials, shops need goods to sell.

Please read this article alongside the one below which gives you more of the direct insurance impact. Together a six to eight minute read.

The Suez Canal blockage and mega ship risks

The grounding of an ultra large container ship in the Suez Canal brought traffic on the central shipping route between Europe and Asia to a standstill. In this Q&A, AGCS Global Head of Marine Risk Consulting, Captain Rahul Khanna looks at some of the potential implications of this incident and highlights some of the risk challenges posed by ever-increasing ship sizes.

What are the challenges of mega ships in general? From a risk management point of view, what lessons can be drawn from this incident?

Insurers have been warning for years that the increasing size of vessels is leading to a higher accumulation of risk. These fears are now being realized, potentially offsetting long-term improvements in safety and risk management.

Such ships generate economies of scale for ship owners but also a disproportionately greater cost when things go wrong. Dealing with incidents involving large ships, such as fires, groundings and collisions, are becoming more complex and expensive.

An interesting an illuminating article. Three minute read.

Financial Confidence

Sanlam announces move to purpose-led organisation and brand

‘Live with Confidence’ business reboot will entrench group as an African champion

Sanlam recently announced that it would reboot its business to become a purpose-led organisation and brand, focused on giving millions of Africans the chance to live with financial confidence. In the next two to three years, the continent’s largest non-banking financial services group plans to catalyse this purpose through an expanded product offering, data and digital transformation, empowerment, building a future-fit culture, innovation and partnerships.

This is going to be exciting to see unfold in practical terms. Sanlam has always made its commitments to the public visible along with other big insurers. A two and half minute read.

Three Steps Towards Financial Freedom

Abdallah Moosa shares some ideas on how we can take steps towards attaining some level of 'financial freedom'. Basically, how we can achieve our life goals, by sorting out our financial affairs.

A practical guide in just over seven minutes. This is a YouTube video with sound advice coming from an experienced financial advisor and a contributor to Mind Matters.

Economic Recovery: How bonds and inflation work together or against one another

Is the punchbowl half full or half empty?

By: Old Mutual Wealth Investment Strategists Izak Odendaal and Dave Mohr

Former US Federal Reserve Chair William McChesney Martin famously said that the job of the central bank is to take away the punchbowl just as the party gets going. In other words, to act pre-emptively by hiking interest rates before the economy overheats and inflation rises. Richard Nixon, then vice-president, blamed Martin’s tight money stance for his defeat in the 1960 presidential election. In 1970, after his second attempt at becoming president succeeded, he fired Martin.

The Fed recently abandoned this old punchbowl theory of monetary policy. After a major review, it effectively decided late last year that the punchbowl needs to remain in place so that the party can get going properly, and the more subdued the party has been, the longer the punchbowl needs to be there. It will only be taken away when guests really start misbehaving.

This six minute article by Old Mutual Wealth Investment Strategists Izak Odendaal and Dave Mohr provides some historical context for the use of the "punchbowl" metaphor and then takes this further by using related figures of speech to describe what is unfolding presently as governments try to balance their economies using interest rates as the base instrument. It is a must read for us all to gain deeper understanding of how this works in practice OR is intended to work in practice!

The Powerful New Financial Argument for Fossil-Fuel Divestment

A report by BlackRock, the world’s largest investment house, shows that those who have divested have profited not only morally but also financially.

In a few months, a small British financial think tank will mark the tenth anniversary of the publication of a landmark research report that helped launch the global fossil-fuel-divestment movement. As that celebration takes place, another seminal report—this one obtained under the Freedom of Information Act from the world’s largest investment house—closes the loop on one of the key arguments of that decade-long fight. It definitively shows that the firms that joined that divestment effort have profited not only morally but also financially.

BlackRock is the biggest asset manager on earth and it could do so much to lead the way ...let's hope it does. An eight minute read.

COVID-19: Business Interruption, Third Wave

The FSCA’s current position on Contingent Business Interruption Insurance

1. Purpose

This Communication sets out the FSCA’s current position on certain aspects of CBI insurance cover as well as its expectations of non-life insurers and policyholders in respect of CBI claims, in order to ensure that the processing of these claims is not unduly delayed and in line with the legal certainty that has been obtained in recent judgments.

2. Position regarding legal certainty

Following recent discussions with the non-life insurers with CBI cover exposure, it was confirmed that they hold the view that legal certainty has been obtained. Insurers have proceeded to review previous and current claims to make sure that claims decisions are in line with the recent court judgments.

This comprehensive article [three minutes reading time] is also available in the latest COVER Magazine on page 16.

RYAN NOACH: A third wave can be avoided — but it could also be more deadly

Preventing viral spread between people limits chances for Covid-19 to mutate, and protects us from infection with any new, highly transmissible variants that may not yet be documented

Will SA experience a third wave of Covid-19 infection? If so, when and how severely? The country experienced the first wave in April 2020, with the Western Cape affected first, which abated by September 2020, with Gauteng being the last province to settle. A devastating second wave followed three months later linked to the migratory patterns of the holiday period and, as the evidence demonstrates, spurred on by super-spreader events in late November and early December. Now we face concern that a third wave could hit us sometime after Easter, coinciding with autumn and potentially compounding the morbidity of the annual flu season.

Ryan Noach is Discovery Health CEO and offers five steps we can take to mitigate the impact of a third wave.

In the July 2020 edition of South African Actuary, we featured the modelling work done by the Actuarial Society’s task team led by Barry Childs. They have since updated the Actuarial Society model they had developed. The Society facilitated a presentation by other modellers later last year. In this edition, we take a look at steps in the development of the NMG model.

This article is on page 38 of the latest edition of the magazine. A four minute read.

The UGLY truth about the Covid-19 lockdowns – Nick Hudson, co-founder of PANDA

PANDA (Pandemics – data and analysis) has been outspoken with regards to the policy-makers’ reaction to Covid-19, lockdowns and other approaches to the virus. Its viewpoints have ruffled feathers over the past year, with many in the establishment openly hostile towards the group of actuaries, accountants, economists and other professionals who participate in the global think tank. Nick Hudson, co-founder of PANDA, spoke at the inaugural BizNews Investment Conference in March 2021. Here’s his keynote address.

This is 27 minute interview and is a good counterpoint to more conservative approaches to managing the pandemic. Listen and watch it if you want to hear the alternative viewpoint.

Medical schemes must shoulder responsibility in broadening healthcare access

Meeting new needs in challenging times

Emerging from the toughest economic year in the country since the Great Depression with a devastating 7% contraction in GDP in 2020, times are tough for South Africans.

Ahead of World Health Day on 7 April, Josua Joubert, CEO and Principal Officer of CompCare Medical Scheme, considers how a medical scheme can broaden access to quality healthcare at this challenging moment in history.

A three minute read on this vital subject.

Enrichment and personal development

In this series of posts I will break down my thesis into digestible blog chucks and go into quite some detail of the emerging field of Causal Reinforcement Learning (CRL) – which is being spearheaded by Elias Bareinboim and Judea Pearl, among others. I will try to present this in such a way as to satisfy those craving some mathematical detail whilst also trying to paint a broader picture as to why this is generally useful and important. Each of these blog posts will be self contained in some way. Perhaps it will be about a specific idea or research paper. In this case, it is just a primer for what is to come. Let’s begin!

Awesome reading - makes you want to hear more about the topic. A four minute read for now, but the next blog is already available!

How to turn everyday stress into ‘optimal stress’

The analogy between sports and stress helps illuminate a big challenge in managing stress: poor self-awareness. At the gym, for example, we’re acutely aware of when we’re straining muscles or resting them (the two phases of supercompensation). And when we consciously add new, varied exercises (behaviors) to our workout, we become stronger and more flexible over time.

The same should be true for managing stress. Yet at any given time, we’re unaware of which stress state we’re in (engagement or recovery), let alone consciously seeking behavior changes that would improve the efficacy of either state. Managing stress, therefore, starts with self-awareness.8

This is an insightful article. Take the trouble to read it by going to the site or read it here below. The article takes a top executive as the person who is stressed out, but that person could just as well be you. It is a very good ten minute read.

Former First Lady Eleanor Roosevelt on considering what you value most:

"To be mature you have to realize what you value most.

It is extraordinary to discover that comparatively few people reach this level of maturity. They seem never to have paused to consider what has value for them. They spend great effort and sometimes make great sacrifices for values that, fundamentally, meet no real needs of their own. Perhaps they have imbibed the values of their particular profession or job, of their community or their neighbors, of their parents or family.

Not to arrive at a clear understanding of one’s own values is a tragic waste. You have missed the whole point of what life is for."

Source: You Learn by Living: Eleven Keys for a More Fulfilling Life